- The Innovation Armory

- Posts

- On the Frontier of Alpha

On the Frontier of Alpha

The next generation of non-traditional investing ecosystems

This week’s piece for the Innovation Armory is on the growth in new, frontier asset classes that democratize investments ranging from farmland to fine art to crypto. Thank you to Carter Molloy (CEO, AcreTrader) and Yoann Turpin (Co-Founder and Head of Business Development, Wintermute) for sharing your perspectives. The next piece will be on architecting digital discovery platforms, with a focus on podcasting and books.

Retail investor trading volume in the public markets has increased substantially through the pandemic. The surge of free trading apps like Robinhood have opened the floodgate of individual investor demand for public securities. During 1H 2020, retail investors contributed ~20% to share trades vs. ~15% in the year prior and have accounted for up to 25% of trade volume on select trading days. This new class of empowered retail traders have had a significant impact in the trading of single name stocks including GameStop in its recent surge from $4 to $350+ per share due to Reddit discussion forum collaboration rather than fundamental value creation in the stock. These investors are also hungry to democratize access to financial markets for common individuals as opposed to larger financial institutions. As retail investors continue to flood the public market in higher numbers than previously, I expect more retail investors to begin seeking alpha in alternative non-traditional markets outside of public equities and public debt.

Last summer, the SEC amended and overhauled its definition of “Accredited Investor.” Previously, high asset thresholds (>$1M net worth) and high income thresholds excluded / constrained a large portion of the American population from participating in private market asset classes. The assumption of the policy was that net worth correlated with the financial sophistication needed to understand private market assets. The new regulation is effective as of December 2020 and allows individuals to participate in private markets “based on established, clear measures of financial sophistication” instead of solely based on income thresholds. As this definition expands over time, private investor demand should naturally expand and it will also become easier and easier for private asset investing platforms to target and onboard potential investors without the barriers of as much SEC redtape and disclosure requirements.

Of the increased retail trading activity, a larger and growing portion has related to complex products including derivatives, inverse and commodity linked products. The mix shift of individual trades to greater complexity has been so rapid that the SEC is weighing adding new protections for self-directed trades in complex products. In the public market, investors are seeking more nuanced and differentiated products to chase better returns. These products are more difficult to understand for “lay” investors and these retail investors should gravitate towards more easily understandable frontier asset classes that could offer a returns premium as those channels become more prevalent and better appreciated by the public.

Cryptocurrency exchanges like Coinbase and commercial real estate investment marketplaces like Cadre have begun to warm up public retail investors to other asset classes outside of traditional public market assets. They have proven that with the right combination of investor education, liquidity and trust-based branding, it is possible to expand public investor horizons to new and emerging asset classes to diversify retail portfolios. Over the coming years, frontier asset classes will also capitalize on this growing willingness of retail investors to diversify into previously illiquid assets such as in farmland (example: AcreTrader), rare collectibles (example: Rally), fine artwork (example: MasterWorks) and income share agreements (example: Edly). For those who aren’t familiar with them, income share agreements service the student loan market. However, instead of repaying a loan with interest, students receive tuition capital from third party investors and repay it by pledging a certain % of their income until they repay the loan vs. being burdened by fixed interest payments.

There are numerous frontier asset classes that could garner increased public interest going forward. However, I believe the best potential is in those areas where either i) existing high net worth individuals (HNWIs) already infrequently trade in illiquid marketplaces (e.g. art). Where HNWI’s already trade, there is more likely to be a premium returns opportunity that is just not accessible yet to the average lay investor; or where ii) consumers already purchase goods but don’t think about the object yet as an investment class (e.g. rare collectibles). I will discuss this point in more detail later in the piece. I spoke with Carter Molloy, CEO of AcreTrader, to learn more about his vision for expanding retail investor access to investing in quality farmland.

My Conversation with Carter Molloy (CEO of AcreTrader)

SN: Could you tell me more about the founding story of AcreTrader?

CM: I was working at a long / short equity fund and had been buying and selling farmland in the background with my dad. We saw really good results for our farmland investments and a neighbor expressed interest in investing with us. We went online to see if we could find a platform to invest with others and there was nothing out there. We had this moment where we realized there is this $3+ trillion asset class with low volatility and high returns with no real access for most investors. Now, we are buying about 1 farm per week through the platform and scaling our aset and investor base.

SN: What are the additional complexities in investing in farmland that has caused it to remain a relatively illiquid asset?

CM: The idiosyncrasies across the asset class are pretty incredible. There is an extra level of expertise required to effectively make a market here. Public equities, fixed income and commercial real estate are relatively larger asset classes and therefore have been more of the historical focus. There is also a large informational barrier. Finding research on Apple’s stock is easy. We could not be further from that in farmland. There is a lack of liquidity and transparency that AcreTrader is looking to build. As a result, if you have great data and agricultural scientists (like we do), your business is a beneficiary of informational asymmetry in the asset class who can open up a market for others. By aggregating agricultural datasets with software we have built and layering in the best human capital, we feel like we have an advantage as a market maker in this asset class.

SN: Your informational asymmetry point is interesting. You see in other asset classes, as there is greater information availability that is incorporated faster into markets, there can be returns compression for average retail investors that are unable to compete with more sophisticated institutions. What does the returns spread look like that you are able to deliver investors?

CM: The concept today of easily measurable and auditable performance data is difficult to track in the context of farmland. In terms of investment performance, all of our investments so far seem to be tracking to plan or better. We are certainly happy with the deals we have done so far. There is not enough information yet, but we have employees directly focused on benchmarking this data. It is a high priority for us in terms of being able to effectively market the asset class going forward.

SN: What are some of the opportunities and challenges around educating retail investors on the asset class?

CM: We have two major yet related barriers to growth: 1) Education and 2) Trust. To us, the best investor we can have is a highly educated one. We spend an inordinate amount of time on investor education including publishing materials, webcasts and more. Trust takes time. People may learn from the site for a couple of months and then eventually dip their toes in a minimum investment on a future deal. As they learn more, they gradually begin to trust the platform so to us, trust and education are intertwined.

SN: Prior to founding AcreTrader, what did the process look like for buying farmland as an individual investor? Did you have to purchase a full plot of land?

CM: The main option was to go out and buy a whole slug of land. You’re talking about going out to a county you have never heard of, with a broker you have never met and plopping down a million dollars or more to manage a farm. That is a non-starter for almost anybody. There are some funds out there that focus on farmland, but the issues there are transparency into the portfolio, investor base exclusivity and high fee loads.

SN: How do you think about segmenting the different pockets of investment opportunity in farmland? Is it about regional or commodity exposure?

CM: We are focused on the US because we have great farmland and stable title laws vs. emerging market countries that may also have great farmland. There has been a lot of diversity available in the US through regions, climate and crop type. We also diversify by row crops vs. permanent crops and existing farms vs. new developments. There are a wide array of options to diversify farmland holdings in the US.

SN: How do you go about your sourcing process and deliver value to individual investors through your selection expertise?

CM: It is a big funnel. We do a lot of marketing to try to find farmland. We work with brokers, bankers, managers and others throughout the value chain. The number one goal is to see as much farmland as you can. In addition to the marketing, we have proprietary software tools to help identify and qualify land. Then it is a matter of understanding whether that offering is the right size, acreage, valuation, etc. We have a three-pronged diligence process to then eliminate as many farms as possible to get down to the best farmland prospects. We look primarily at water, soil and financial profile as key determinants. Marketing, data / software and people are the key drivers of this process. Given the agricultural focus, human capital is especially important in this sourcing process.

SN: I assume you force investors to hold for a long period of time given current market liquidity constraints. Over the medium-to-long term, what do you see as the average hold period for a retail investor in farmland? Do you envision instant / real-time trading being accessible ever in this asset class? What about short-term speculations / bets on crop cycles and weather events?

CM: I don’t think we will see that sort of daily trading and speculation anytime soon. Shorter term speculation already happens in the crop and commodity world all the time. That is where people want to go and bet on weather. We typically do 3-5 and 5-10 year types of deals. With that being said, after a one-year regulatory lock-up, the investor has the option to sell the position to someone close in their network. We are happy to facilitate that transaction. However, where we would like to get is to have a more robust secondary market to facilitate liquidity sooner.

SN: Do you actually operate the farms? If you work with existing farm owners, do you see value in enabling these farm operators with other agricultural technology tools to improve farmer yields? Could there be convergence between the fintech side of agricultural investing and agtech tools?

CM: In some cases we do own the farmland ourselves and in others we work with third party managers. Where we work with third party managers, a big part of our value proposition is that it needs to be a win-win for farmers and investors. We are certainly working to provide them additional value today and would like to do that even more going forward. Whether that is partnering to transition land to organic, diversifying their crops or improving their yield, there are numerous ways to provide additional value through a combination of advice and capital. This value-add tends to be less about technology tools as we don’t necessarily want to be in the business of speculating on which innovations will win out. We can’t be everything to everyone.

Transforming a Frontier Asset Class to Mainstream

My conversation with Carter had me thinking about what factors enable an asset class to move from the fringes / frontier of investing into mainstream portfolios for retail investors. I believe there are several criteria that can help effectively catalyze this change for marketplaces currently on the frontier of asset management:

Passivity of Income - Most retail investors want to passively earn income without dedicating too much of their time to trading, let alone managing an asset. Part of why retail trading volume has spiked is because mobile apps have seamlessly enabled frictionless self-directed trading. Retail investors have day jobs outside of trading and so will stray away from assets that they have to actively operate or manage both because of the high time investment and their lack of sector expertise. ActreTrader is a great example of a marketplace that removes this friction by outsourcing the management of farmland investments so that “lay” farmland investors can own shares in land but passively earn a return over time.

Lower Financial Barriers - Certain large asset classes stay on the frontier and only accessible to high net worth individuals because the cost to participate is so high. In the fine art industry, one painting could be worth tens of millions of dollars. Moreover, much of the auctioning of these investment assets occurs in exclusive auction houses where only those above certain income thresholds are even invited to participate. MasterWorks sources and purchases multi-million dollar fine art pieces and lists shares so that individual investors can buy equity in fine art in much smaller denominations enabling those with lower incomes to participate in the upside of fine art asset appreciation.

Knowledge Democratization - the knowledge that is required to make investment decisions and understand the drivers of asset appreciation in frontier classes is less accessible. There are numerous research tools and platforms out there to help parse through and analyze the financial profiles of public corporates. Moreover, these companies are more tangible and understandable to the average consumer because they often interact with them in their daily lives. However, understanding what makes a good fine art or farmland investment is much more esoteric and requires a more niche knowledge set. AcreTrader’s online webinars, publications and investor resources are great examples of democratizing the knowledge that is needed for less experienced retail investors to feel comfortable investing in farmland.

Lead Qualification - Given the asymmetric expertise and knowledge gap between market makers and retail investors in the early days of a new asset class, it is important that market creators screen investment opportunities to include the best quality leads for potential investors. Qualifying opportunities with industry and asset specific metrics minimizes the chance that early investment opportunities yield poor outcomes for early adopters of the asset class. There’s no better way to freeze and deter future capital allocations to an emerging asset class than for early investors to lose money because the marketplace did a poor job of screening out lossmakers. Rally has a strong vetting process of sourcing noteworthy collectible goods from a trusted network of appraisers around the world. Maintaining a strong lead qualification process is a critical way to engender trust in a new exchange.

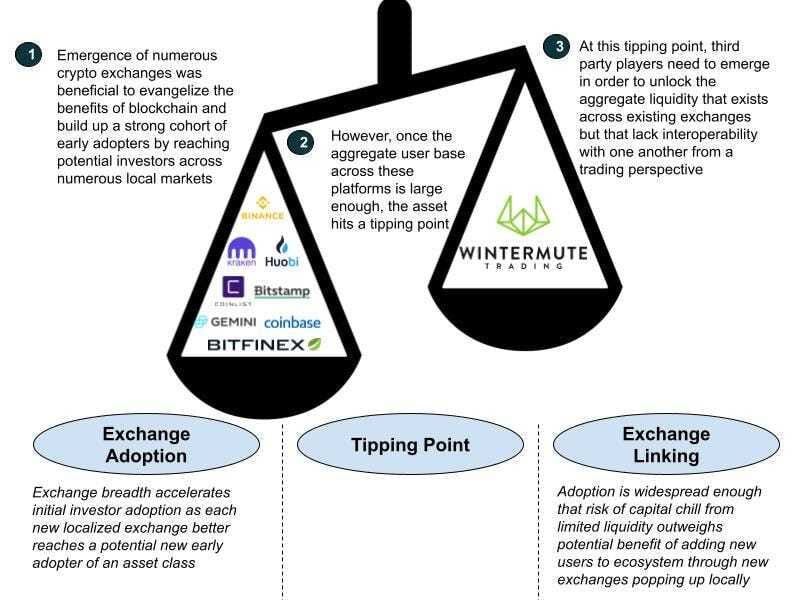

Create Liquidity - Of course, it is impossible to generate strong liquidity with a minimal investor base. However, as these frontier asset classes gain greater retail investor adoption, it becomes increasingly more important to enable opportunities to resell ownership in a trusted and reliable secondary market. Individual investors are less amenable to having their capital locked up for longer periods of time. Early adopters may be okay with accepting longer investment horizons in alternative asset classes, but to truly become publicly accessible to the masses, these markets must accelerate liquidity options as they mature. With more liquidity comes accelerated trading velocity which is important to engage investors, minimize duration risk and drive platform engagement.To learn more about liquidity-making in new and frontier asset classes, I caught up with Yoann Turpin, Co-Founder and Head of Business Development at Wintermute. Wintermute is an algorithmic liquidity provider for cryptocurrency and other digital assets. The business is one of the largest providers of liquidity in the crypto markets covering 50+ crypto exchanges and one of the largest assortment of trading pairs. Please enjoy this snapshot of my conversation with Yoann:While digital trading generally reduces market friction for new asset classes, it has also enabled local exchanges to more effectively go directly to individual retail investors to sell digital assets. This has been compounded by cheap access to capital from VCs for businesses building localized exchanges. This means that like crypto, frontier digital asset classes are more likely to be traded across numerous smaller exchanges as an asset class grows in the frontier. While these local exchanges can be an effective way to reach and educate consumers of a frontier asset class at its outset, over time, they pose liquidity challenges. There becomes a tipping point where the asset is mainstream enough that the focus ought to shift to liquidity unlock across existing exchanges vs. new exchange creation. The initial propensity for diffuse trading across platforms only compounds the need for liquidity makers like Wintermute to reduce pricing arbitrage and ensure markets still work efficiently in a relatively decentralized trading world. Once there are a large number of users across exchanges and moderate trading volume, if the ecosystem does not act to unlock liquidity soon enough, it risks chilling capital allocation as the asset becomes a less reliable universal storer of value. I summarize the trade-off between early investor reach in a digital asset’s exchange adoption phase vs. liquidity making in its exchange linking phase:

Elevate Education - building businesses around these frontier asset classes is just as much about marketmaking as it is about marketing a new financial product. Because the average investor is largely unfamiliar with the returns opportunities in the new asset class, these businesses need to evangelize with data, how their asset class stacks up against historical public equity and fixed income returns. If you can’t validate the returns opportunity, it will be very difficult to convince someone to take a dollar out of a different investment account where they earn a known return. For example, MasterWorks, markets that Andy Warhol and George Condo pieces have historically appreciated at 12% and 20% per year. Educational marketing can also focus on social issues as opposed to being returns-based / financially focused. Edly’s marketing around Income Share Agreements is a good example that markets around alignment of investor financial goals, societal social goals and students’ professional success while helping provide students more flexibility than standard debt packages.

Enable Infrastructure - certain potential asset sectors have infrastructure gaps (either digital or physical) that make it substantially more difficult to trade in a certain good. Within fine art, for example, shipping is extremely complex and costly and can cause friction to higher throughput of art transactions. Convelio coordinates the complex logistics process for fine art by analyzing value, fragility and dimensional aspects to determine the optimal shipping mode and route. Since MasterWorks needs to purchase a painting outright before listing shares, it could leverage an infrastructure partner like Convelio to enable it to cost effectively and efficiently list more shares of new paintings.

Mindset Shift - Unlocking potential in these markets can require a mindset shift from consumer to investor. However, this can be a positive if there are already strong consumption habits for a specific asset in its product form. For example, antiquing is a popular consumer trend and consumers attending flee markets like to consume rare collectible goods from old baseball cards to antique lamps. Otis is another company similar to Rally that identifies as the “stock market for culture.” Consuming collectibles is already a part of our culture and Otis and Rally are leveraging that base to turn collectibles consumption habits into collectibles investment volume.

All Innovation Armory publications and the views and opinions expressed at, or through, this site belong solely to the blog owner and do not represent those of people, employers, institutions or organizations that the owner may or may not be associated with in a professional or personal capacity. All liability with respect to the actions taken or not taken based on the contents of this site are hereby expressly disclaimed. These publications are the blog owners’ personal opinions and are not meant to be relied upon as a basis for investment decisions.